RIA vs. IAR: Understanding the Difference

Jan 28, 2026

·

15 min read

Contents

RIA and IAR are two common acronyms in the financial services industry that often confuse fintech founders and executives. Both fall under the investment advisory space but refer to different categories of registrations: one for the advisory firm and one for the individual advisor.

A Registered Investment Advisor (RIA) is the company or legal entity registered to provide investment advice for a fee. An Investment Advisor Representative (IAR) is the individual who provides that advice on behalf of the RIA.

This distinction is more than technical. It shapes who needs to register with regulators, who carries fiduciary responsibilities, and how your fintech should structure its compliance program if it involves giving investment advice.

This article explores the distinction between Registered Investment Advisors (RIAs) and Investment Advisor Representatives (IARs), including who needs to register, what compliance requirements apply, and how recent regulatory updates impact advisory operations, especially for fintech firms.

At InnReg, we help RIAs and IARs navigate registration, licensing, and ongoing SEC and state-level compliance requirements. Our team supports firms with program development, supervisory processes, and day-to-day operations. Contact us to learn more about InnReg’s RIA compliance services.

The Confusion Around “RIA vs. IAR”

At first glance, RIA vs. IAR seems like a minor distinction. Both are part of the same regulatory ecosystem and often appear together in filings, marketing materials, and legal documents. But in practice, confusing the two can lead to registration errors, compliance gaps, and miscommunication with regulators.

A Registered Investment Advisor (RIA) is a firm that holds the registration and bears the regulatory obligations. On the other hand, an Investment Advisor Representative (IAR) is the licensed individual who delivers advice on behalf of that firm. The difference is not a mere technicality because it defines who the regulator holds responsible for what, which directly affects how a fintech builds and manages its advisory operations.

For fintech companies developing investment platforms or advisory features, this distinction determines how the business must register, staff, and structure compliance oversight. For example, a founder planning to provide advice through an app may need to register the company as an RIA and themselves as an IAR.

What Is an RIA (Registered Investment Advisor)?

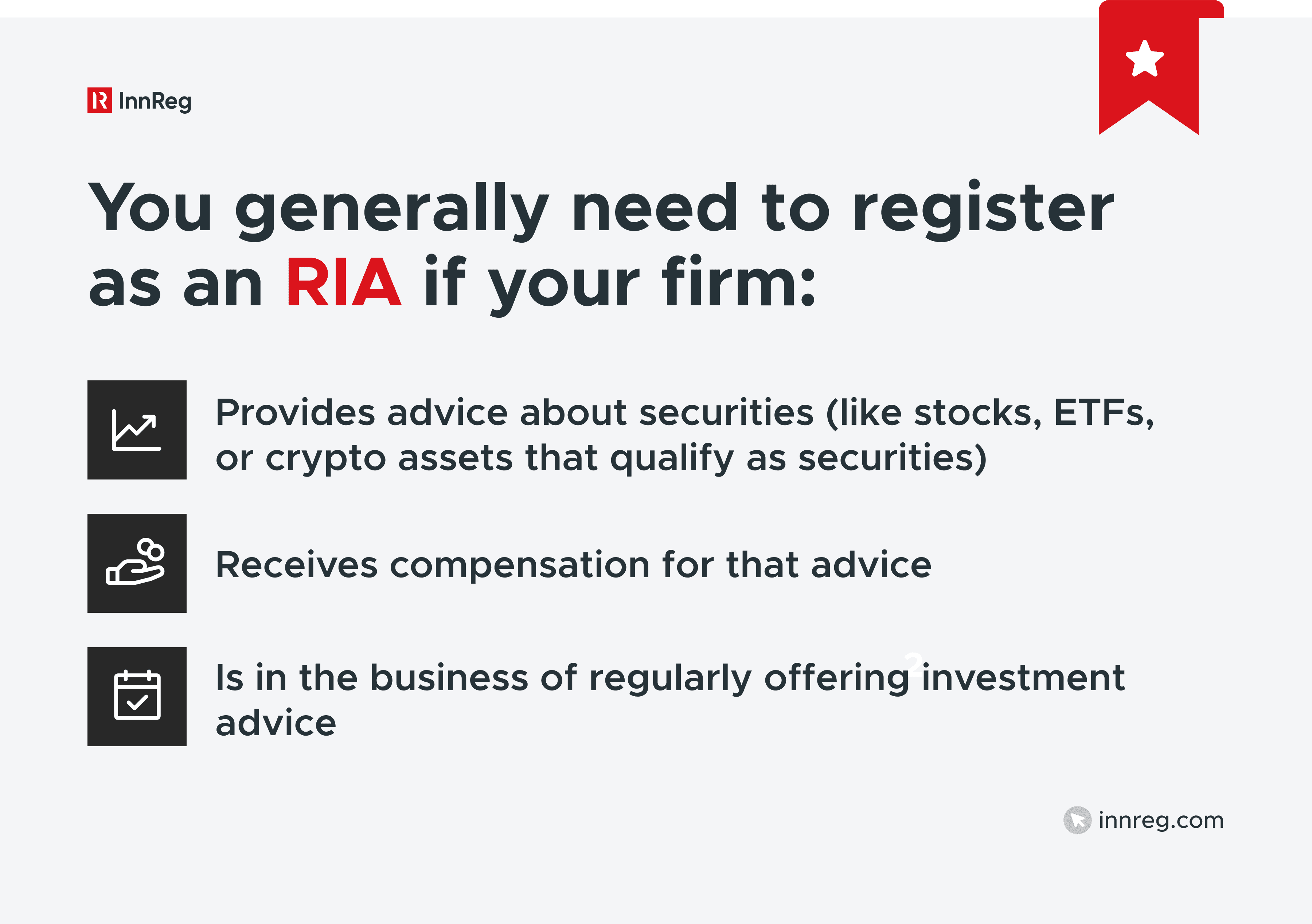

A Registered Investment Advisor (RIA) is a firm or legal entity that provides investment advice to clients for compensation. This designation comes from the Investment Advisers Act of 1940, which sets the regulatory framework for firms that advise about securities. Under this law, RIAs are required to act in the best interest of their clients: a fiduciary standard that forms the foundation of their compliance obligations.

Advisors managing over $100 million in assets must register with the Securities and Exchange Commission (SEC). Those managing less than that typically register with state securities regulators, unless an exemption applies. Certain internet-based or “robo-advisors” may qualify to register directly with the SEC even if they manage less than $100 million, provided they meet specific criteria related to the delivery of advice online.

Common Examples of RIA Business Models in Fintech

Fintech firms can qualify as Registered Investment Advisors (RIAs) under several models. The structure depends on how the company delivers investment advice and earns revenue from it.

Below are a few common RIA models in the fintech space:

Business Model | Description | Regulatory Considerations |

|---|---|---|

Robo-Advisors | Digital platforms that use algorithms to manage client portfolios automatically. | Typically register with the SEC under the Internet Adviser Exemption; must maintain disclosures on algorithmic methods, data inputs, and conflicts of interest. |

Hybrid Platforms | Combine human financial advisors with digital tools for planning or investment management. | Must supervise both automated and human-delivered advice under one compliance framework. Often operate as RIAs with multiple IARs. |

Micro-Investing Apps | Apps allowing users to invest small amounts or round up transactions into portfolios. | If portfolios are managed or personalized, registration as an RIA is usually required. Custody and disclosures about fees are key compliance areas. |

Thematic or Alternative Investment Platforms | Offer access to niche or alternative investment strategies, such as ESG or private markets. | Must assess whether recommendations constitute investment advice and, if so, register as an RIA or partner with one. |

Digital Family Office or Wealth Platforms | Technology-driven wealth management models serving high-net-worth or retail clients. | Require robust fiduciary and disclosure frameworks; often operate under SEC registration due to AUM levels. |

Many fintech founders assume that technology changes how regulators view advisory activity. In reality, the same fiduciary and disclosure requirements apply, whether advice comes from a human or an algorithm.

For startups developing such platforms, partnering with compliance specialists early can streamline registration and program design. For example, InnReg often assists fintech RIAs in building practical, regulator-ready frameworks that align with fast product development cycles.

Federal vs. State Registration Thresholds

Whether an advisory firm registers at the federal or state level depends on the amount of assets under management (AUM) and the nature of its business. Understanding this threshold is critical because it determines which regulator oversees your firm and what compliance rules apply.

Advisors generally register with the SEC if they:

Manage $100 million or more in AUM, or

Expect to reach that threshold within 120 days, or

Qualify under specific exemptions, such as the “internet advisor” exemption for firms providing advice exclusively through digital platforms.

On the other hand, advisors managing less than $100 million in AUM typically register with one or more state securities regulators. Each state has its own registration process, fees, and ongoing filing requirements.

State registration often works best for smaller or regionally focused firms. However, firms operating across multiple states may face additional administrative work since they must comply with each jurisdiction’s unique requirements.

Criteria | Federal (SEC) | State |

|---|---|---|

AUM Threshold | $100 million or more | Below $100 million |

Primary Regulator | SEC | Individual state securities division |

Registration Form | Form ADV Parts 1 & 2 (filed through IARD and reviewed by the SEC) | Form ADV Parts 1 & 2 (filed through IARD and reviewed by each state) |

Exams Conducted By | SEC Division of Examinations | State securities examiners |

Typical Registrants | Large advisory firms, robo-advisors, and national fintech platforms | Smaller, regional, or emerging advisory firms |

Fiduciary Duty and Core Compliance Obligations

Every RIA operates under a fiduciary duty: a legal and ethical obligation to act in the best interests of clients. This is one of the defining features that distinguishes RIAs from broker-dealers and sets the tone for how advisory firms must structure their compliance programs. The fiduciary standard means that RIAs must:

Prioritize clients’ interests above their own or the firm’s business interests

Disclose conflicts of interest clearly and transparently

Recommend only suitable investments based on the client’s goals, risk tolerance, and financial situation

These requirements apply equally to fintech RIAs that use algorithms or automated advice models. Even if an investment recommendation is generated by technology, the firm remains responsible for the quality and fairness of that advice.

What Is an IAR (Investment Advisor Representative)?

An Investment Advisor Representative (IAR) is an individual who provides investment advice to clients on behalf of a Registered Investment Advisor (RIA). The IAR is the human connection between the advisory firm and the client: the person responsible for explaining recommendations, managing accounts, and maintaining client relationships.

Under state and federal law, an individual must register as an IAR if they are in the business of giving investment advice or soliciting advisory clients for compensation. This includes making specific recommendations, managing client portfolios, or supervising others who do.

You typically need to register as an IAR if you:

Provide advice about securities to clients of an RIA

Are compensated for advisory activity

Supervise or manage others who perform advisory functions

There are limited exemptions for individuals performing only administrative, clerical, or impersonal research roles. However, anyone engaging directly with clients about investment decisions must be registered.

How IARs Fit Under the RIA Structure

RIAs are firms, while IARs are the professionals who work under them. Each IAR must be “associated with” an RIA. There can be no independent IAR without an advisory firm’s registration.

In practice, this means a fintech founder who provides investment advice through their own firm must register both the company as an RIA and themselves as the IAR of that RIA. Larger firms often have multiple IARs serving under one RIA registration.

This structure helps regulators assign accountability clearly: the RIA oversees the business-level compliance framework, while the IAR is accountable for conducting advisory activities ethically and in the client’s best interest.

See also:

Licensing Exams (Series 65, 7/66) and Qualifications

Anyone who wants to register as an IAR must demonstrate the required competency through licensing exams or qualifying credentials. These exams confirm that an advisor understands securities laws, ethical standards, and investment principles.

Most IARs qualify through one of the following:

Series 65 (Uniform Investment Advisor Law Exam): The most common path for standalone IARs. This exam focuses on investment strategies, regulations, and fiduciary responsibilities.

Series 7 and Series 66 Combination: Often used by individuals who also hold broker-dealer registrations. The Series 7 covers securities products and trading, while the Series 66 covers laws and ethics specific to advisory activities.

Professional Designations: Some states waive exam requirements for recognized credentials such as CFP®, CFA®, or ChFC®.

After passing the appropriate exam, an individual must file Form U4 through the FINRA CRD system. This links the IAR to their supervising RIA and provides regulators with background information such as work history and disclosures.

Learn more about FINRA exams and licenses →

Need help with RIA compliance?

Fill out the form below and our experts will get back to you.

IAR Continuing Education

Under the NASAA Model Rule, many states now require annual continuing education (CE) for IARs. The rule typically mandates 12 hours per year, split between product knowledge and ethics training.

Failing to complete CE can lead to license suspension or renewal delays.

For fintech firms, it is important to track these requirements across states. Compliance teams or outsourced partners like InnReg often manage licensing renewals and CE tracking for multi-state operations, keeping advisor status current while minimizing administrative strain.

Fiduciary Responsibilities at the Individual Level

While a Registered Investment Advisor (RIA) carries firm-level fiduciary obligations, individual Investment Advisor Representatives (IARs) have their own set of fiduciary responsibilities to clients. These responsibilities define how an IAR interacts with clients, provides advice, and upholds ethical standards.

An IAR must:

Act in the client’s best interest when making investment recommendations or managing portfolios.

Disclose all conflicts of interest, including compensation arrangements or outside affiliations that could influence advice.

Provide advice that is suitable and well-informed, considering each client’s investment goals, financial situation, and risk tolerance.

Follow the RIA’s compliance policies on supervision, recordkeeping, advertising, and communication.

These responsibilities apply whether the IAR is working with clients directly or through a fintech platform that automates investment advice. Regulators view the IAR as the person accountable for maintaining the fiduciary duty in practice, even if technology supports or executes the recommendations.

RIA vs. IAR: Key Differences at a Glance

Although the terms RIA and IAR are closely related, they represent two distinct regulatory categories. The table below summarizes the key differences:

Category | Registered Investment Advisor (RIA) | Investment Advisor Representative (IAR) |

|---|---|---|

Entity Type | Firm or legal entity | Individual person |

Registration Level | Federal (SEC) or State | State only |

Regulatory Oversight | SEC or State Securities Regulator | State Securities Regulator |

Registration Form | Form ADV (Parts 1 & 2) | Form U4 |

Primary Obligation | Establish and maintain firm-wide compliance | Deliver advice in line with fiduciary duty and firm policies |

Fiduciary Standard | Applies at the firm level | Applies at the individual level |

Typical Role | Owns the client relationship and sets policies | Provides advice and manages client interactions |

Exams or Qualifications | None (firm-level registration) | Series 65, Series 7/66, or qualifying credentials |

Compliance Accountability | Oversees supervision, advertising, and recordkeeping | Must follow the firm’s supervision and disclosure policies |

Regulatory Framework and Oversight

Understanding how RIAs and IARs are regulated helps fintech founders determine how their firms and professionals fit into the broader compliance structure.

The investment advisory industry is governed by a mix of federal and state regulators, each with distinct responsibilities:

Federal vs. State Oversight

RIAs are regulated based on their assets under management (AUM) and business model:

The Securities and Exchange Commission (SEC) oversees RIAs with $100 million or more in AUM or those that qualify under specific exemptions, such as internet-based advisors.

State securities regulators oversee RIAs managing less than $100 million in AUM and handle the registration of all IARs, regardless of firm size.

This dual system means a fintech firm could be supervised by both the SEC and one or more state regulators, depending on where it operates and the location of its clients.

Role of FINRA and the IARD/CRD Systems

While the Financial Industry Regulatory Authority (FINRA) does not regulate RIAs or IARs directly, it administers the systems used for registration: the Investment Adviser Registration Depository (IARD) and the Central Registration Depository (CRD).

These systems are where firms and individuals file:

Form ADV for RIA registration

Form U4 for IAR licensing and disclosures

FINRA also manages the exams required for IAR qualification, even though it does not oversee the advisory profession.

Learn more about FINRA CRD →

See also:

Registration Forms

Both RIAs and IARs must register through standardized filings that disclose their structure, services, and disciplinary history. These filings are made through the FINRA-managed Investment Adviser Registration Depository (IARD) and Central Registration Depository (CRD) systems:

Form | Used By | Purpose | Filed Through |

|---|---|---|---|

Form ADV | RIA firms | Registers the firm with regulators. Describes ownership, business activities, services, fees, and disciplinary history. | IARD System |

Form U4 | IAR individuals | Registers the advisor representative. Reports employment, qualifications, exams, and disclosures. | CRD System |

These filings are public disclosures that form the official record that regulators and clients use to evaluate an advisor’s background and credibility.

RIAs must keep Form ADV current by updating it annually or whenever material changes occur, such as new ownership, fee changes, or disciplinary events. IARs must do the same with Form U4, especially when they change firms or face new disclosure events.

Public Disclosure Databases and What Information They Show

Both regulators and the public can access information about RIAs and IARs through official disclosure databases.

These systems help investors verify registration status, review disciplinary history, and understand the scope of an advisor’s activities:

Investment Adviser Public Disclosure (IAPD): Operated by the SEC, this database provides detailed profiles of RIAs and IARs. Users can view a firm’s Form ADV, disciplinary history, ownership structure, and types of advisory services offered.

FINRA BrokerCheck: While primarily designed for broker-dealers, BrokerCheck also includes some IAR data because it draws from the same Central Registration Depository (CRD) system. This makes it a helpful supplemental resource when reviewing professionals with dual registrations.

Both IAPD and BrokerCheck serve as transparency tools. They help clients and regulators confirm whether a firm or individual is properly registered and whether any disciplinary actions exist.

For fintech firms, maintaining accurate and updated filings in these databases is essential to regulatory credibility. Inconsistent or outdated information can trigger inquiries or slow down licensing renewals.

Compliance Requirements for RIAs

Before an RIA can begin advising clients, it must complete several regulatory steps. Registration is only the first layer of compliance. Once registered, the firm takes on ongoing responsibilities to disclose information, maintain records, and operate under a fiduciary framework that regulators can review at any time.

Registration Process and Form ADV

To operate legally, every RIA must complete the registration process by filing Form ADV through the Investment Adviser Registration Depository (IARD).

This form is divided into two main parts:

Form ADV Part 1: Provides firm-level data, including ownership, disciplinary history, and business structure.

Form ADV Part 2: Functions as a narrative brochure, explaining services, fees, and conflicts of interest in plain language for clients.

After filing, regulators review the application, typically within 30 to 45 days for SEC-registered firms, though the timeline varies by state. Registration does not indicate approval of business quality. It simply confirms that the firm has met disclosure and procedural requirements.

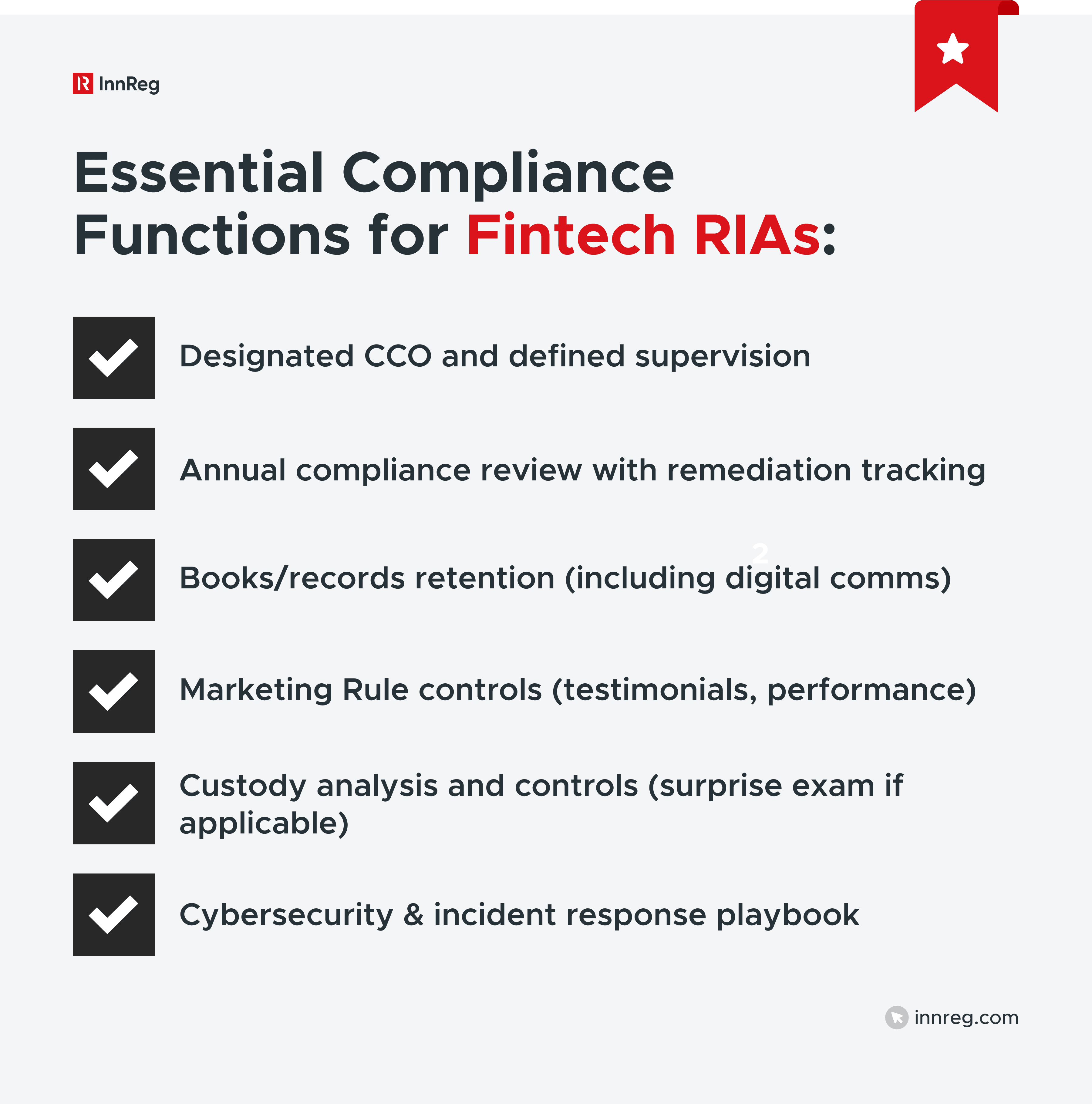

Required Compliance Policies and the Role of the Chief Compliance Officer (CCO)

Once registered, RIAs must maintain a written compliance program designed to prevent regulatory violations.

Each firm must also appoint a Chief Compliance Officer (CCO) responsible for developing, monitoring, and updating these policies.

Key compliance areas include:

Supervision: Oversight of all advisory activities and personnel

Advertising and Marketing: Adherence to the SEC’s updated Marketing Rule

Custody: Safeguarding client assets in compliance with SEC custody requirements

Cybersecurity and Data Privacy: Maintaining safeguards against unauthorized access or data loss

For fintech firms, outsourcing the CCO role can be both efficient and cost-effective. That’s why InnReg provides fintechs with external CCOs, managing day-to-day compliance operations while integrating into the firm’s tech stack and internal workflows.

Learn more about our outsourced chief compliance officer services →

Annual Reviews, Filings, and Recordkeeping

Regulators expect RIAs to conduct annual compliance reviews to evaluate policy effectiveness. These reviews help identify risk areas and confirm that business operations align with the firm’s disclosures in Form ADV.

In addition, RIAs must maintain accurate records of:

Client agreements and communications

Advertising and performance materials

Financial statements and trade records

Most states and the SEC require that records be preserved for at least five years, with the first two years kept in an easily accessible location.

Marketing Rule Obligations

The SEC Marketing Rule (Rule 206(4)-1) allows RIAs to use testimonials, endorsements, and performance data in marketing, but only with appropriate disclosures and recordkeeping.

SEC enforcement actions have recently focused on violations of this rule, particularly around hypothetical performance and influencer marketing.

Learn more about the SEC Marketing Rule →

See also:

Custody and Cybersecurity Considerations

Firms that hold client funds or have the authority to transfer assets must comply with the Custody Rule. To avoid custody and its associated compliance requirements, firms often use qualified custodians to custody client assets and obtain client authorization for all withdrawals or securities movements.

Cybersecurity is another critical component of compliance. Regulators increasingly expect RIAs to adopt written information security policies covering access controls, data encryption, and incident response.

Learn how to get the most out of the FINRA cybersecurity checklist →

Compliance Requirements for IARs

Just like firms, individual advisors have their own set of regulatory responsibilities. These obligations begin at the licensing stage and continue throughout an IAR’s professional activity, covering education, supervision, and disclosure requirements.

State Licensing and Continuing Education

Each IAR must register at the state level, even if their supervising firm is federally registered. The process involves filing Form U4 through the FINRA CRD and completing the required licensing exams or credential-based exemptions.

Many states have adopted the NASAA Model Rule, introducing annual continuing education requirements for IARs. The standard is 12 hours per year, six covering investment products and practices, and six focused on ethics and professional responsibility. Advisors who do not complete CE may have their licenses placed in inactive status until requirements are met.

Ongoing Disclosure and Supervision by the RIA

IARs are responsible for keeping their registration data current, meaning that updates to Form U4 must be made promptly whenever there are changes in employment, address, or any disciplinary or legal matters.

Each firm (RIA) must also supervise its IARs to confirm that advisory activities align with its compliance framework. This includes reviewing client communications, monitoring investment recommendations, and conducting periodic compliance training.

In fintech settings, supervision may extend to algorithmic advice, automated communications, and platform-based interactions.

Handling Dual Roles

In some cases, professionals act as both IARs and broker-dealer representatives. This dual status can create conflicts of interest, particularly when compensation structures differ between commission-based and fee-based services.

Firms must document how they manage these conflicts. Clear disclosures and separate workflows for brokerage versus advisory activities help maintain transparency and reduce compliance risks.

Recordkeeping and Communication Standards

IARs must follow their firm’s recordkeeping and communication policies, which typically cover client interactions, trade approvals, and marketing materials. Communications that are business-related must be documented and stored in a retrievable format.

Regulators increasingly review digital channels such as chat tools, texts, and social platforms during examinations. Fintech firms should confirm that all advisory-related communications, human or automated, are captured and archived in line with regulatory requirements.

Key Takeaways

When comparing RIA vs. IAR, the key differences define how a fintech advisory firm operates and complies with regulations.

The key differences include:

RIA = the firm, IAR = the individual: In short, an RIA is the registered firm responsible for compliance at the organizational level, while an IAR is the licensed individual who provides advice under that firm’s supervision. Both roles are essential to building a compliant advisory business model.

Shared fiduciary standards and oversight: Both RIAs and IARs operate under a fiduciary duty to act in the client’s best interest. Regulators evaluate each differently: firms for system-level compliance and individuals for conduct and qualifications.

Structure and registration: Clarifying your RIA and IAR structure early helps avoid registration errors, inconsistent filings, and supervisory challenges. For fintech founders, this clarity supports scalable compliance operations and smoother regulatory interactions as the business grows.

Many fintechs partner with experienced compliance experts like InnReg to develop registration strategies and operational frameworks that align with their business model from the outset.

—

Understanding the difference between RIAs and IARs is essential for fintech founders building or scaling advisory products. The RIA carries firm-level registration and compliance obligations, while the IAR represents the individual advisor accountable for client-facing conduct.

Getting these roles right from the beginning supports efficient compliance operations, credible relationships with regulators, and a structure that can grow with the business.

For fintechs entering or expanding in the advisory space, thoughtful planning helps align innovation with regulatory expectations from the start.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with RIA compliance, reach out to our regulatory experts today:

Last updated on Jan 28, 2026