Contents

How many fintech companies from Canada do you know? Probably not many, yet. While Silicon Valley and the US East Coast often dominate the fintech landscape, Canada’s budding financial technology ecosystem is fast becoming a part of the global scene.

Despite often being overlooked, Canada is home to several innovative fintech companies that deserve recognition. From robo-advisors to lending platforms and innovative payment solutions, Canadian fintech companies like Wealthsimple, Borrowell, PayBright, Clearbanc, and Sensibill are transforming the industry with their forward-thinking approaches.

Our compliance advisory and operations team compiled a list of the top small fintech companies in Canada to watch in the next two to five years. As Canada continues to foster a supportive environment for financial innovation, it's only a matter of time before these hidden gems shine on the global stage.

InnReg compliance experts with decades of experience wrote this analysis, not freelance copywriters, third-party agencies, or ChatGPT. We worked with multiple fintech startups that embed AI into their products and operations.

See also:

Overview of Canada Fintech Landscape

According to Statista, the digital investment market is expected to reach US$3.89 billion AUM in 2023, highlighting the increasing trust in fintech adoption.

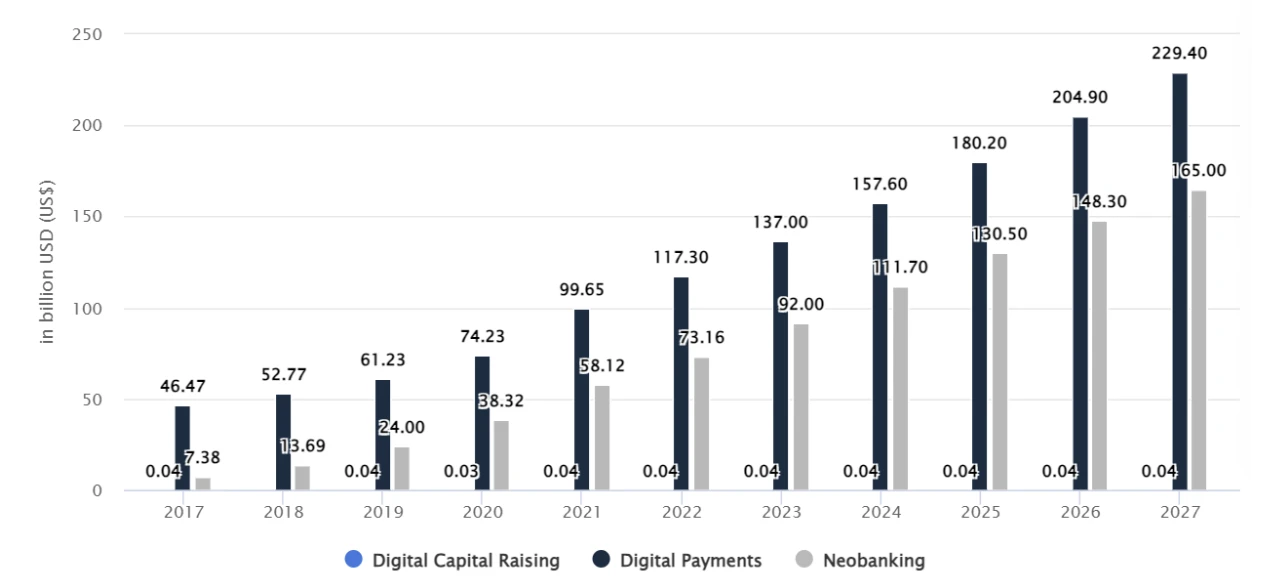

Transaction Value By Segment, Fintech Canada

Source: Statista - Fintech Canada

The average AUM per user is projected to be US$816.00, showcasing the value individuals place on these platforms.

The digital assets market is projected to grow by 36.3% in 2024, driven by the rising popularity of cryptocurrencies and NFTs. This presents new avenues for financial growth and exploration.

The digital payments market is experiencing exponential growth, with an estimated 32.22 million users by 2027. As cashless transactions become more prevalent, the demand for seamless payment options continues to rise.

Each fintech niche has unique characteristics and metrics for success. Therefore, evaluating key performance indicators within their respective niches is critical.

Top 10 Small Fintech Companies in Canada (Updated 2025)

Here's a list of the top 10 promising and thriving Canadian fintech companies to watch for (in alphabetical order):

1. Bitbuy

HQ Address: 110 Cumberland St, Toronto, ON

Fintech Niche: Crypto & Blockchain Digital Assets

Description: Bitbuy Technologies Inc. is a cryptocurrency company and the first crypto trading platform to become regulated as a marketplace.

2. FlipGive

HQ Address: 325 Front St West, Suite 400, Toronto, ON

Fintech Niche: Crowdfunding

Description: FlipGive is a shopping rewards app for teams that unlocks sales and shopper loyalty through community givebacks. They partner with some of the world’s leading brands to connect with shoppers and inspire deep-rooted brand loyalty.

3. FrontFundr

HQ Address: 325 Front St W, 4th Floor, Toronto, ON

Fintech Niche: Crowdfunding

Description: FrontFundr is the leading equity crowdfunding platform in Canada. It empowers Canadians to invest in companies they believe in, providing entrepreneurs with the essential funding to drive growth.

4. Hubdoc

HQ Address: 250 University Ave, Suite 400, Toronto, ON

Fintech Niche: Bill Automation | Document Management

Description: Hubdoc leverages cloud computing and machine learning to automatically collect and analyze business documents for financial reporting, reconciliation, and audit proofing.

5. Letus

HQ Address: 1030 West Georgia Street, 710, Vancouver, BC

Fintech Niche: Digital payments | Real Estate, and Property Management Technology

Description: Letus (previously RentMoola) is an award-winning cloud payment platform offering flexible rent, credit reporting, and 360-degree payment solutions that enable customers to take control of their finances.

See also:

6. LowestRates.ca

HQ Address: 1910 Yonge Street, 401, Toronto, ON

Fintech Niche: Robo-Advisor

Description: LowestRates.ca helps consumers select the right insurance, mortgage, loan, and credit card offer by comparing rates on these products from 75+ Canadian providers.

Need help with fintech compliance?

Fill out the form below and our experts will get back to you.

7. RemitBee

HQ Address: 3660 Hurontario St, Suite 400, Mississauga, ON

Fintech Niche: Money Transfer | Remittances

Description: RemitBee is an online money transfer company. They offer the best exchange rates and have a super intuitive platform.

8. Payfirma

HQ Address: 1185 West Georgia Street, Suite 740, Vancouver, BC

Fintech Niche: Mobile Payments | Online Payment Gateway | API

Description: Payfirma is a payment company that helps businesses accept credit and debit cards online, in stores, and on mobile devices.

9. Zapper

HQ Address: 1751 Rue Richardson, Bureau 7.107, Montreal, QC

Fintech Niche: Blockchain | NFTs | DeFi | DAOs

Description: Zapper lets their customers manage all of their DeFi assets in one location. They simplify asset transfers by allowing customers to connect their existing wallets or plug in a valid BTC or ETH address.

10. Zeffy

HQ Address: 917 Avenue du Mont-Royal E, Montreal, QC

Fintech Niche: Crowdfunding

Description: As a SaaS, Zeffy has tripled each year and brought transparency into the fundraising world as the only 100% free fundraising and donor management platform for nonprofits. Four fundraising tools have been added to offer an all-in-one, simple experience for nonprofits.

Who Regulates Fintech Companies in Canada?

Multiple regulators oversee various aspects of financial services and fintech companies in Canada:

Investment Industry Regulatory Organization of Canada (IIROC)

Office of the Superintendent of Financial Institutions (OSFI)

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

All these authorities regulate certain fintech products and services, including “money services businesses” (MSBs) dealing in fiat and/or virtual currency and the retail payment sector.

Canadian Securities Administrators (CSA)

The Canadian Securities Administrators (CSA) is a collective organization of securities regulators in Canada. Its main goal is to enhance and standardize regulation of the Canadian capital markets. It strives to reach agreement on policy choices and collaborate on implementing regulatory initiatives, including continuous disclosure and prospectus submissions.

Investment Industry Regulatory Organization of Canada (IIROC)

The Investment Industry Regulatory Organization of Canada, also known as IIROC, supervises investment dealers and trading activities on Canada's debt and equity markets. IIROC's main objectives are to safeguard investors, uphold market integrity, and foster trust among Canadians regarding financial regulation and the individuals handling their investments.

Office of the Superintendent of Financial Institutions (OSFI)

The Office of the Superintendent of Financial Institutions (OSFI) is a separate federal government agency responsible for overseeing and monitoring over 400 federally regulated financial institutions (FRFIs). Its primary role is to assess the financial soundness of these institutions and ensure their compliance with regulatory requirements.

Canada Revenue Agency (CRA)

The Canada Revenue Agency (CRA) administers tax laws for the Government of Canada and various provinces and territories, and implements social and economic benefit programs supported by the tax system.

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

FINTRAC is Canada's financial intelligence unit and supervisor in the fight against money laundering and terrorist financing. It aids in identifying, preventing, and discouraging these illegal activities while safeguarding personal information.

Canada's Federal Anti-Money Laundering (AML) Authority

FINTRAC is Canada’s AML regulator consisting of thirteen federal departments and agencies, each with its own specific mandates and responsibilities, coordinated by the Department of Finance Canada. Provincial and municipal law enforcement agencies, along with provincial and territorial regulators, also combat these unlawful activities.

Bank of Canada (BoC)

As the country’s central bank, the Bank of Canada aims to enhance Canada's economic and financial well-being. Their key responsibilities include monetary policy, ensuring a secure financial system, managing currency, overseeing government funds, and supervising retail payments.

Provincial and Territorial Securities Administrators

CSA or Canadian Securities Administrators is also primarily responsible for the provincial and territorial securities in Canada as it was formed by ten provinces and three territories to create a harmonized approach to securities regulations across the country’s multiple jurisdictions.

How to Connect with Canada's Fintech Community?

Connecting with the fintech community in Canada can transform startups, entrepreneurs, and professionals working in the financial technology industry. As a rising star in the fintech hub, Canada provides numerous opportunities for networking, acquiring knowledge, and collaborating with others in the field.

See also:

Canadian Fintech Forums: Events and Conferences

Participating in fintech meetups and conferences is essential to engage with Canada’s financial technology community. The country hosts events year-round, providing opportunities for networking and staying updated on industry trends. Prominent gatherings in Canada that attract fintech enthusiasts, entrepreneurs, and investors from around the world include:

The Canadian Fintech Summit: An annual gathering of fintechs, investors, enterprises, financial Institutions, AI enterprises, and service providers from around the world to learn, engage, and build relationships.

Canada Fintech Week: Canada Fintech Week and Canada Tech Week are two major events that bring together leading experts and companies in fintech and technology.

Fintech Cadence: Founded in 2017 as a fintech hub in Montreal, Quebec by Jan Arp (now Founding Managing Partner at the HoltXChange), on the premise that this city had all the right ingredients to foster innovation in the financial sector and create world-class Canadian fintechs. They host a number of events, including social gatherings.

Canada FinTech Forum: A landmark international gathering that showcases emerging global trends in fintech, new technology solutions for the financial industry, and emerging fintech start-ups.

Canada Fintech Symposium: Canada FinTech Symposium 2024 in Calgary, Alberta, is poised to become a groundbreaking milestone for the industry in Calgary, as it marks the city’s first inaugural fintech conference. With its grand debut on the conference calendar, the event promises to be a platform that brings together visionaries, innovators, and thought leaders in the space.

What are the Biggest Challenges a Canadian Fintech Faces?

Fintech companies in Canada face several challenges that must be addressed for the industry to thrive and compete on a global scale. These challenges include regulatory barriers, legacy systems, difficulties in creating fintech apps, high levels of trust in the traditional financial sector, and the impact of the COVID-19 pandemic.

1. Nascent regulatory frameworks

The Canadian regulatory framework has been weak in supporting fintech adoption. To overcome this, Canada can learn from other countries that have successfully created thriving fintech industries and implemented regulatory policies that align with global digital trends.

2. Transition from legacy systems to modern protocols

Transitioning from traditional legacy systems to modern technologies like 5G, the Internet of Things, and machine learning requires deliberate effort. Middle-ground solutions can be adopted to make the transition easier, such as processing data locally before moving it to the cloud.

3. Large investments are required to build secure fintech apps for users

Building fintech apps that meet customer needs and ensure data security can be challenging. The government can provide support and credit facilities to fintech startups to encourage rapid growth and innovation in the industry.

4. High level of trust in the traditional financial sector

The strong reputation and sophistication of Canada's financial institutions create a high level of trust among consumers and the government. Encouraging a shift towards alternative financial services requires support from stakeholders like regulators and policymakers.

5. The COVID-19 pandemic investments decline

The recent pandemic has negatively impacted spending on digital transformation initiatives in Canada.

Despite these challenges, experts predict a healthy projected annual growth rate of 13% over the next five years.

Conclusion: Canadian Fintech Scene Looking Into 2025

As we look towards 2025, we expect to see continued growth and innovation in the Canadian fintech sector. The ecosystem's strong foundation and the changing investment landscape create a favorable environment for companies to thrive. With the right strategies and support, Canada has the potential to become a global leader in fintech, driving economic growth and creating exciting opportunities for both investors and consumers alike.

Fintech in Canada is poised to thrive in the coming years, with a flourishing landscape of over 1,200 companies. The country's unique combination of technological expertise, a robust financial sector, early adopters, skilled professionals, and government support provide a fertile ground for the growth of successful global fintech ventures.

Furthermore, the mindset of fintech companies regarding investments and funding is evolving.

In 2021, the rebound of substantial venture capital investments allowed many companies to extend their financial runway well into 2023-2024. Instead of chasing rapid growth at any cost, fintech companies are now focusing on sustainable growth and conserving cash for the long term, aiming to achieve profitability in the near future. This shift in approach demonstrates the maturity and resilience of the fintech industry in Canada.

By prioritizing financial sustainability and profitability, companies are positioning themselves for long-term success and securing their position in the competitive fintech markets.

InnReg has been working with several Canada-based fintechs aiming to expand into the US market. These clients span various sectors, including broker-dealers, RIAs, and neobanks.

Similarly, InnReg has also assisted US-based fintechs in expanding their operations globally, including the Canadian market. Canada has its own set of financial market regulations, often tied to the US fintech regulatory landscape.

If you need assistance with your Canada fintech or plan to expand to the Canadian market, click here to reach out for a complimentary consultation.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with compliance, reach out to our regulatory experts today:

Published on Dec 27, 2023

Last updated on Jan 12, 2025

Related Articles

All Fintech

Feb 12, 2025

·

11 min read

All Fintech

Dec 26, 2024

·

18 min read

All Fintech

Dec 11, 2024

·

8 min read

Latest LinkedIn Posts